With the average debt in the United States rapidly rising, many individuals are looking for a better way to manage their bank accounts, credit cards, savings and investments. While there are lots of software solutions available, cutting edge Web 2.0 technology has given rise to many new money management tools and services that make keeping track of personal finances easy. However, don’t let all the jargon make choosing between these tools difficult.

If you have never used a Web 2.0 money management tool or service, don’t miss out on all the advantages they offer. Here’s a monster list of 18 of the top Web 2.0 finance services currently available. This list covers new sites offering services in a variety of specialized fields ranging from online banking, personal finance, investing, business tools, shared bills and housing prices. Be sure to fully investigate all the features and security details on a site before signing your life away and deciding which one best fits your needs. Or you can just choose the site with the coolest logo, always a fundamentally sound means of selection.

Enjoy, and let us know what you thought of your experiences with these sites.

ONLINE BANKING/PERSONAL FINANCE

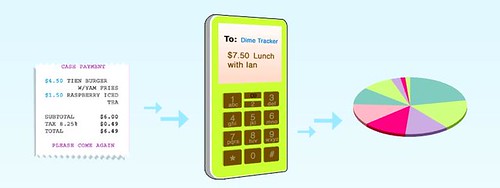

1. DimeTracker

DimeTracker is an easy to use tool that is perfect for keeping track of everyday expenses. If you are a person that constantly makes small purchases that land you in hot water when you fail to include in your check book this program is for you. DimeTracker is 100% free to use and has a mobile feature which can be used on the go. Use DimeTracker to keep tabs on spending at fast food restaurants, last minute grocery store visits, and other small expenses.

2. Foonance

Foonance is a personal finance service designed with families, couples, and the average person in mind. This service takes a personal approach to money management with a user friendly, fun, interface that isn’t nearly as intimidating as some other sites. Foonance lets users quickly import their bank statements and other financial information so that new users can get started managing their money quickly. Users can set up different transfers between accounts and schedule transactions such as mortgage and student loan payments. These transfers can be categorized for easy reference later and pending balances can even be viewed to avoid confusion. Users have the ability to view their net worth in the program so that they always know their financial situation without having to toggle through accounts.

Bank Switcher is a tool that makes changing banks much easier to manage. The tool goes through your banking account transactions to easily determine what things will be affected by a bank transfer, including direct deposits and scheduled payments. Once these items have been identified users can print out a checklist of items that need to be changed and businesses that need to be notified about your bank transfer.

4. Wesabe

Wesabe is an interactive, web-based, personal finance monitoring tool. This tool lets you manage your finances by directly interacting with your bank account, savings account putting it a step above other financial tools that only reflect the information you remember to input. Free membership is available but paying for the tool is well worth it since you get access to all the best features that will give you the maximum return on investment. Wesabe also lets you discuss saving advice and personal experiences with other users, making it one of the few Web 2.0 money management sites to actively encourage public discussion of finances and wealth.

5. PearBudget

Pear budget is an extremely easy to use finance managing tool that offers new users a free 30-day trial. If you have had a hard time using personal finance software like Quicken and Microsoft Money should give this user friendly program a try as PearBudget is perfect for people who have never had any luck with using finance programs before or have no experience managing their budget. If you enjoy tracking your finances with PearBudget it is extremely affordable to keep using: users are charged only $3.00 per month to keep their accounts active.

6. Money2Manage

Money2Manage is an extremely easy to use software program that can be used to take care of all of your financial management needs. The easy to use app is perfect for users who have never used a financial management program before. Money2Manage lets users manage multiple accounts so that you can keep track of several different transactions in one place. It is also easy to set up a list of payees so that you can keep track of who needs to be paid what and when they need to be paid. You can easily create categories to make it easier to track different types of accounts.

7. Spendji

Spendji is an all-in-one personal finance management tool for families and friends that have a great deal of planning to do. The site helps families create budgets that the entire family can follow: this includes handling bills, groceries, discretionary spending and much more. In addition to helping with budgeting, Spendji can be used to research costs before a trip and track expenses. Families and friends can also use Spendji to communicate and share important dates and news. Spendji is free to sign up with.

8. NetworthIQ

NetworthIQ is a free Web 2.0 financial management tool that can be used to keep track of all debts, account balances, and much more. This is a relatively easy to use tool that helps individuals track basic financial information. It does not have many of the tools available with other, paid-for, services but it is nevertheless useful. NetworthIQ lets users share their information with other members and even display your net worth on your personal website or blog. For those of you who are private you do have the option of keeping your information to yourself. Even if you do choose to share, none of your personally identifiable information is ever made available to other members.

INVESTING

9. Zecco

Zecco combines a free online investing tool with a financial community. Users can set up an account at no charge and make stock trades without paying commissions or fees. This feature alone makes the site extremely popular with individuals who are interested in stock trading but unable to afford the fees and commissions associated with trading. In order to sign up for an account you must be able to provide proof of employment, a copy of government ID and your banking information. This information must be faxed to Zecco before you can start using the system.

BUSINESS TOOLS

10. Analysis One

Analysis One is an online tool designed to help businesses manage their finances and keep track of their organization. The tool is extremely easy to use but provides a wide variety of professional features that will primarily help business increase efficiency and productivity. The core competency of the app helps businesses to analyze their financial performance and identify strengths and weaknesses.

11. Endeve

Endeve is an online electronic invoicing tool that can be used by self-employed individuals or businesses. Invoices can be created in only five minutes: there’s no more messing around with paper invoices and keeping track of paper receipts. These electronic invoices will help your business manage clients and keep track of revenue that is earned. Once you get started with this system you will cut down on the amount of revenue being lost because of poor invoicing habits.

12. Xpenser

Xpenser is an online tool designed to keep track of forgettable business expenses as soon as they are incurred. The tool is completely free to use and works with mobile devices including cell phones, Twitter, IM, and PDAs. Xpenser gives users an easy way to document expenses such as client dinner meetings, last minute travel and unexpected hotel expenses immediately. Xpenser helps cut down on reporting and expense errors that take place when spur of the moment business expenses are not accounted for, which saves you money and time.

Clarity Accounting is designed with the needs of professionals and small business owners in mind. It is a must have for self-employed individuals who have a hard time keeping their personal and business expenses separate. Clarity Accounting helps manage the income earned through professional work and the expenses that go towards business necessities. Multiple users can access Clarity Accounting, and it also has extensive customer support if needed. Clarity Accounting also makes it easy to back up information in case of a computer crash or other malfunction.

SHARED BILLS/IOUs

14. Billshare

Billhsare is an easy to use program designed to make sharing bills and expenses easy. It allows multiple users to create bills for divided receipts and track group spending habits. Email alerts keep all users up to date on activity within the group along with balances and amounts that are owed. The program also lets members record money exchanges with each other. Billshare is perfect for roommates or family members living together and sharing expenses.

15. iOWEYOU

iOWEYOU is a unique expense-tracking program designed for anyone involved with casual lending and borrowing. It lets friends and family members easily keep track of who owes who what amount of money. The service is designed to be used by multiple individuals so that everyone can be involved and aware of transactions. iOWEYOU is great for family members who split household expenses and friends that are constantly arguing over who owes who money. Bear in mind that this is not intended to be used to manage personal finances or keep track of large sums of money, rather it is meant to replace classic “I Owe U” notes so all parties are the same financial page.

16. Ripple

Ripple is a site that puts a unique spin on the idea of IOUs by putting the money you are owed by friends and family to work. Ripple lets you take a debt that is owed to you by one friend and trade it to another friend for something of immediate value. The website lets users create an account connected with a list of trusted friends and family members (that are also users) and trade debts. The value and sphere of debt trading grows as more friends and family encourage their own friends to join Ripple. The site can be a bit confusing at first but it is also a very useful for large groups of family members and friends that are constantly juggling IOUs and small debts.

17. Scred

Scred is another tool designed to help friends manage money and keep track of shared expenses. This program is different from other IOU type tools because it actually allows the currency to be changed to cover international travel or help deal with friends that live overseas. Scred is great for managing expenses associated with group items such as shared dinner bills and other small shared expenses that have a tendency to add up over time. There’s also a handy mobile feature making it easy to use when out and about and the program will help users balance out all debts and expenses.

HOUSING/RENT

18. RentoMeter

RentoMeter is a tool that can be used by anyone that needs to find an affordable place to live. This Web 2.0 service will help make sure you get the most bang for your hard-earned buck when looking for a new home or apartment by letting you know whether or not you are paying too much, or too little, for your home or apartment. Some RentoMeter users were able to save hundreds of dollars per month when they found cheaper apartments and homes in their area.

No Mint.com? I've been using it for awhile and does everything I want

I second mint, it's a fantastic site. Great silent revenue generating system too.

At last the EURO shows level of potency just as before.